Futures trading is great but as a customer you expect and rely upon a seamless, fast, and always working client. Bitmex has had serious problems meeting these requirements, which I’ve written about before regarding the dreaded Bitmex order submission error. When you’re trading a position in a highly volatile asset the last thing you want to see is your platform not working. About a year ago there wasn’t many viable options to Bitmex, but that has definitely changed in 2019.

Here’s reviews of my top 3 favorite Bitmex alternatives with Pros and Cons for each.

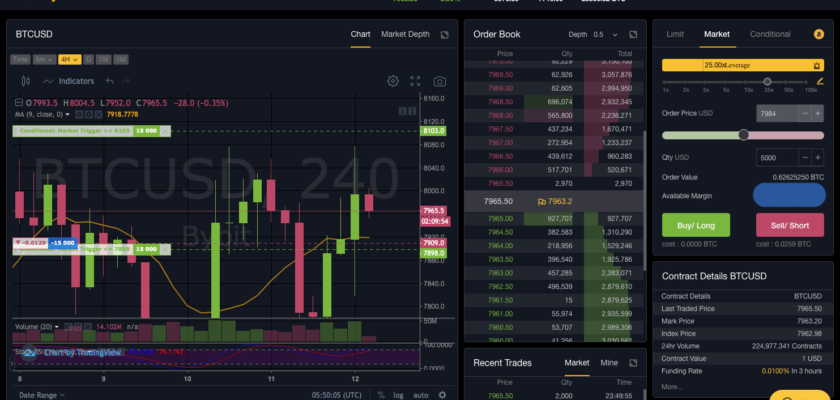

1. Bybit (https://www.bybit.com)

Recognize that UI? Yeah looks a lot like Bitmex doesn’t it? You’ll have no issues switching over to Bybit as many things have stayed the same.

Pros

- Trading Bonuses! Bybit is running a promotion that provides a FREE $10 margin trading bonus, simply by signing up for an account. Receive a $50 bonus upon depositing a minimum of .2 BTC OR 6 ETH.

- Bybit is legally structured in the British Virgin Islands, with their headquarters based in Singapore.

- Gorgeous and familiar UI with a customizable trading GUI. It’s Bitmex, minus the system overload errors. Liquidity has been growing steadily since they launched.

- Trade bitcoin in BTC but to trade the other tokens you can deposit ETH, XRP, or EOS. So you can margin trade: BTC, ETH, XRP, and EOS in their respective coin.

- Lightning fast trades — With their advanced matching engine they claim capabilities for 100k tps (transactions per second). So far ZERO overload issues from my experience.

- Limited KYC.

- Less orchestrated “wick-quidations“ or flash crashes you often see on Bitmex.

- System encourages stop loss / take profit measures at the time of order.

- Same fees structure: Takers (market order) pay 0.075% on each trade, Makers (limit order) receive 0.025% on each trade.

- Awesome support — My questions were answered quickly and courteously.

- Bybit has a robust trading API.

- Website works great on mobile.

Cons

- Needs better order book depth, I like to zoom out and see the orders accumulating far away from price.

- Allowing a user to see order sizes on the book rather than accumulated totals would be nice – I noticed the mobile version of the website does this so maybe I missed it.

- No movable limit/stop orders right within the chart like Bitmex.

- Restricted for United States of America or Québec (Canada), and Singapore.

Sign Up → Bybit (https://www.bybit.com)

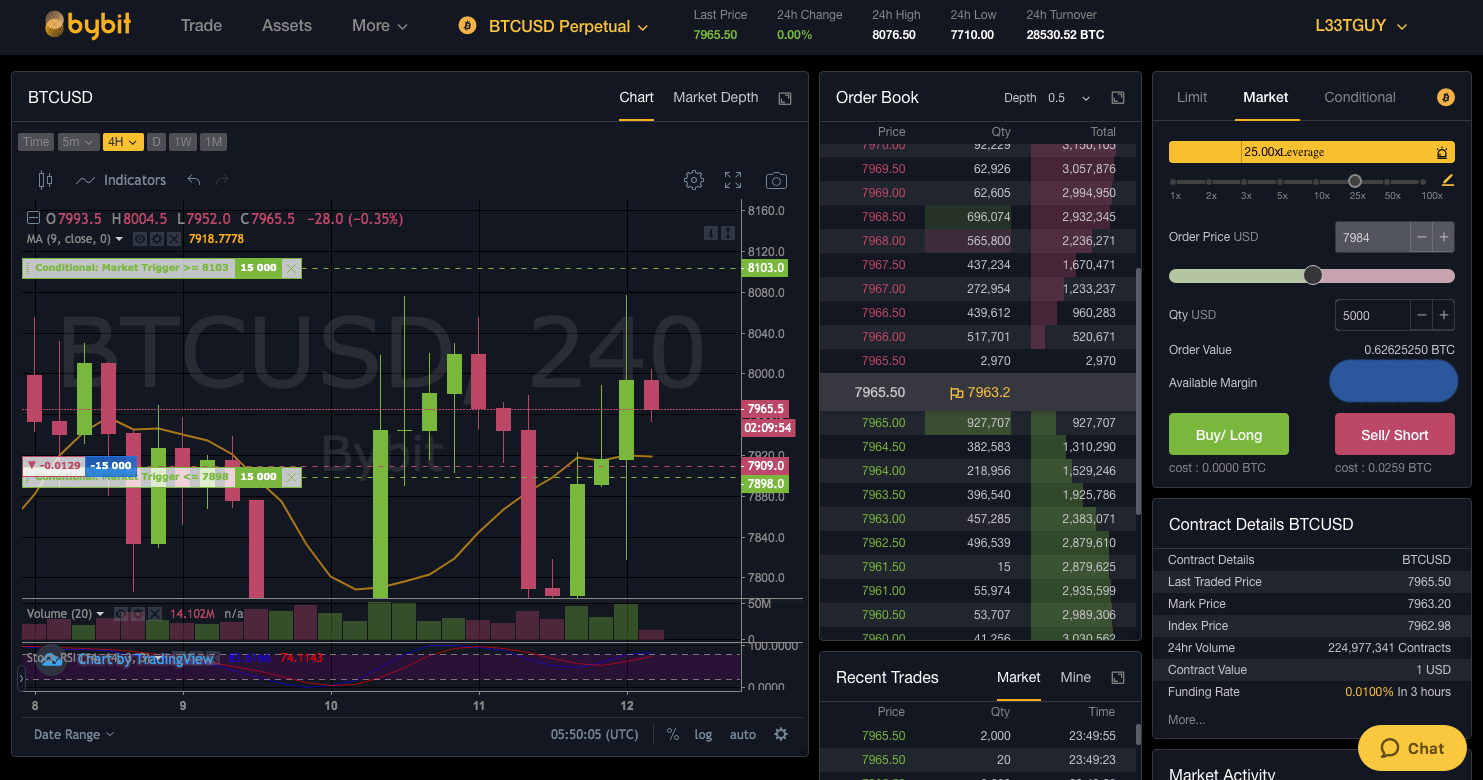

2. Deribit (https://www.deribit.com)

Deribit is a fantastic alternative to Bitmex, and also includes sophisticated option trading, unlike anyone else. These guys have been around since 2016 and hail from Amsterdam. They don’t currently accept customers from the Netherlands or the US, but there was no KYC/AML on account setup either, if you use a VPN. The fee structure is slightly different so I’ll share it here:

Perpetual Contracts

Maker Rebate: 0.025%

Taker Fee: 0.075%

Futures

Maker Rebate: 0.02%

Taker Fee: 0.05%

Options

0.04% of underlying or 0.0004 BTC/option contract

Fees can never rise more than 12.5% of the price of the option

Pros

- A perpetually running funding system, unlike Bitmex and Bybit. This means you’re constantly paying funding rather than paying it at a specific time.

- Familiar and extremely pleasant trading UI, with lightning fast executions via their advanced matching engine.

- Deribit is legally structured / based in the Netherlands, but their servers are in France.

- Anonymous accounts allowed, no KYC.

- Movable limit/stop orders right within the TradingView chart like on bitmex. Love this!

- No troll box (good).

- Robust trading API.

- Website works great on mobile.

- Often has hilarious meme-worthy marketing and fun contests the community really enjoys.

Cons

- Deposit only BTC.

- Needs more coins, only ETH, BTC for now.

- The placement of the panels is perfect for me, but you can’t customize them.

- Restricted for US and the Netherlands.

Here’s a detailed video review I did recently on Deribit below, and remember if you signup to use this link to save 10% on fees.

Sign up → Deribit (https://www.deribit.com)

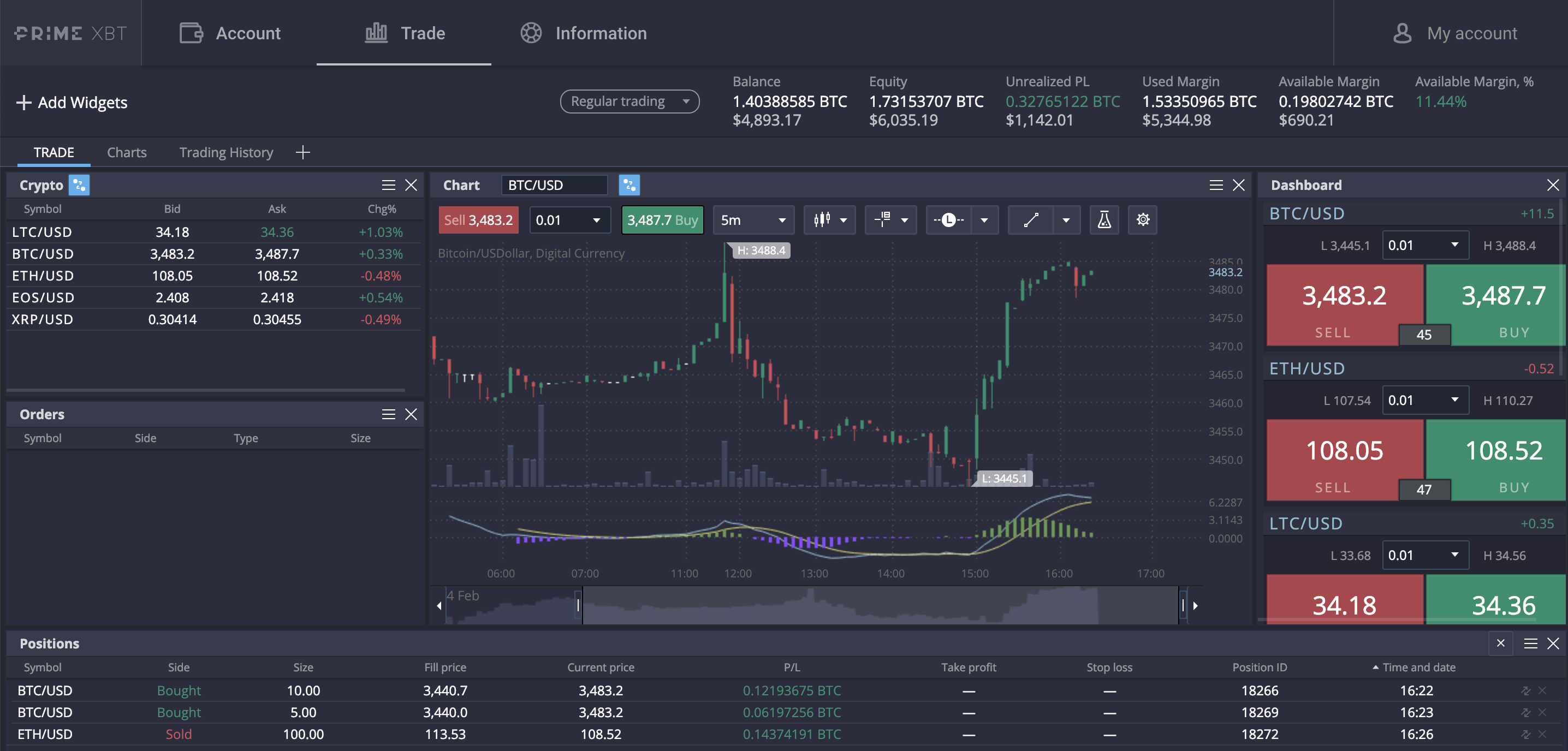

3. PrimeXBT (https://www.primexbt.com)

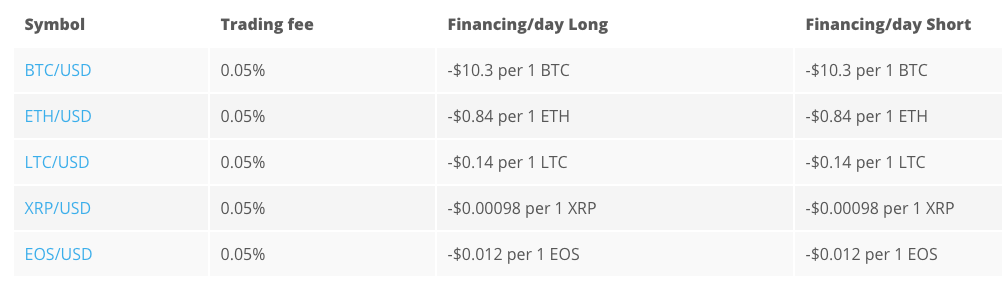

These guys came on the scene in early 2019 and offer the familiar futures offerings. They also have a really nice UI with leverage up to 1000x. Yes, seriously! The fee structure is different at PrimeXBT and includes an overnight fee, take a look below:

So PrimeXBT charge two types of fees: a trade fee and overnight financing. You finance the traded value through an overnight financing, and this borrowing cost (financing) is dependent on the liquidity of the underlying asset. If you open and close a leveraged position within the same trading day, you are not subject to overnight financing.

Pros

- Advanced and gorgeous trading platform, very polished.

- Ability to trade BTC, ETH, LTC, XRP, EOS.

- Can also trade forex pairs, commodities, and indices.

- They are registered in the Seychelles which is a “safe” jurisdiction for these types of instruments.

- Very attractive fee structure for scalp and day traders.

- Anonymous accounts, no KYC.

- High leverage up to 1000x.

- Claims high security features.

Cons

- Deposit only BTC.

- No API yet.

- Restricted for US and Canadian traders.

Sign Up → PrimeXBT (https://www.primexbt.com)

Thanks for reading guys. For charting definitely check out TradingView and good luck in your trades!

Follow

YT : youtube.com/l33tguy

TW: twitter.com/l33tguy

W: anons.ca